This is the most Progressive and Generous Investment Tax Credit Law in the US.

The Hawaii State Legislature adopted ACT 221/215 as a means to encourage investment in high technology businesses, provides a 100% investment income tax credit to investors, and is deductible from the Hawaii taxpayers Net Income Tax Liability. This also applies to the licensing fees paid by the Banks and Insurance Companies. The maximum amount is $2 million annually, per investor, per QHTB. We expect to have four (4) QHTB's under management in the next 18 months.

Maui Energy Group L.L.C. qualifies under Non-Fossil Fuel Technologies and Services. (Non-fossil fuel energy-related technology)

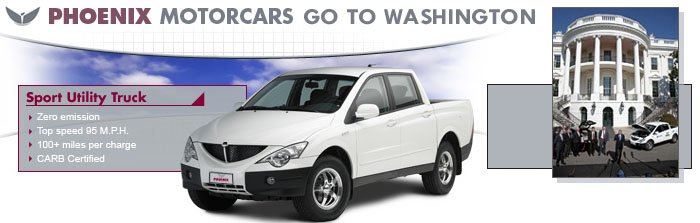

Major Manufacturers are interested in working closely with us for Research and Development purposes including but not limited to everyday use trials, data acquisition / analysis, further development and standardization, maintenance and service, and the development of our infra-structure around our Electric Rapid Charging Stations located for convenient use around the Island of Maui, and the first V2G Smart Grid Electricity Management Systems supported by Phoenix Motorcars Altairnano Battery Pack Systems.

The Energy Revolution has begun and will change our lifestyles forever……. We can make a difference.

Hawaii's Diversification/High Tech Tax Incentives - Act 221/215

In short, Act 221/215 is probably the most aggressive packages of tax incentives in the USA, providing a 100% tax credit against Hawaii State taxes, for equity investments in Qualified High Tech Companies (QHTB). Investors claim this credit front-loaded over five years. QHTB's are involved in one or more of the following activities:

Research & Development

Development and Design of Computer Software

Non-Fossil Fuel Energy Related Technology...Maui Energy Group...

Biotechnology

Astronomy

Performing Arts Products (that are created or perceived via a computer)

Ocean Sciences

Sensor and Optic Technology

Non Profit investors or investors who do not have Hawaii income tax liabilities (e.g. investors from out of state) can have their investment be claimed by other investors in the deal who do have Hawaii income tax liabilities, although the additional credit claimed is capped at two

( 2 ) times the Hawaii tax payer's investment. This provision is to encourage Hawaii investors, who as a group have historically invested primarily in real estate, to partner with mainland investors who are more experienced in investing in "knowledge work" based companies. The mainland investors, in turn are more likely to invest when there are local investors involved.

There are other benefits including a 20% refundable tax credit for research and development (as defined by the Federal Internal Revenue Code), no Hawaii income tax on royalty income paid on the licensing of intellectual property, and more.

Here is an overview of Act 221 by Ray Kamikawa, the lawyer who as State Tax Director wrote the law, and is now in private practice helping businesses take advantage of the law.

Ray Kamikawa Summary:

You may obtain a comfort ruling from the State Tax Department verifying whether or not you are eligible for the benefits. Go to Department of Taxation High Tech Tax Incentives to read more and to download the draft comfort letter that you will customize for your situation. This will include inserting two or three paragraphs under "Statement of Facts" briefly describing your company, why you qualify for the tax incentives, your goals over the next five year, and why you and your team have the background to pull this off. In a two to three page Exhibit A you will elaborate on the "Statement of Facts" describing milestones for each of the projected five years including expected jobs created and investment. You will also need to list existing owners of your company and the nature of their investment. Information on the Tax Dept. site is posted last in first out, so you will need to go to the bottom of the site to get the basic info. Also if you are reading this page off line, go to http://www.hawaii.gov/tax (the full URL is long and complicated) and then pick the quick link on the top right corner for High Tech Tax Incentives. As of January 2006 there is a $1,000 fee for reviewing proposed comfort letters This has helped to finance staff to do the reviews and is significantly speeding up the process.

Act 221 was passed in the spring of 2001 with bipartisan support in the Hawaii Legislature. In 2003 Governor Lingle expressed concern that Act 221 was going to cost too much and that it was being abused. She proposed making changes to the law and after two legislative sessions there have been some small modifications and an extension of the law until 2010 (Act 215). Over $125 million has been invested under Act 221 since 2001 as of the spring of 2006 which represents the most dramatic move towards diversifying Hawaii's economy in recent history.

You Can make a Difference!

Marty from Maui....

No comments:

Post a Comment